From Scope to Strategy to Tactics

One of the more challenging aspects of this Avanceé initiative has been in taking some/most of the insights from engagements and distilling them into more widely understood content. Journaling from past experiences can be a heuristic to leverage.

Without giving away any proprietary information, can speak of an attempt to shift an executive view from day-to-day reactions, to scoping industry verticals/trends, towards proposing tactics shaped by known constraints and future trends. The following keeps pertinent details.

Creating A Scoped View

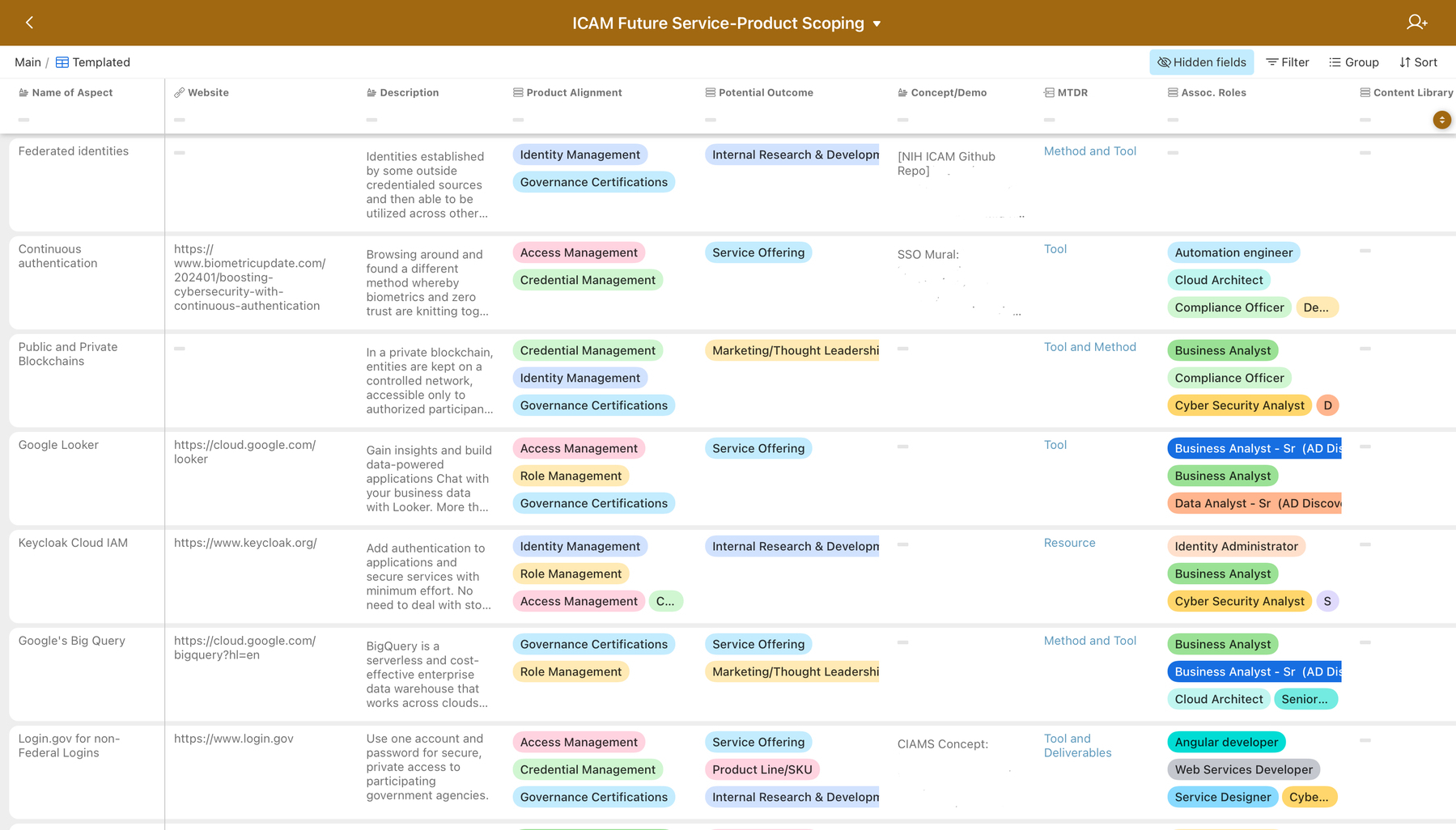

After some time analyzing the day to day functions of the primary company operations around ICAM (identity, credentialing, and access management), we focused on a dozen high-level topics as a topical umbrella to key projects and sales operations. These were compiled on a SharePoint list. This list was architected to connect to a few other SharePoint list to connect to context which might better shape strategy and illustrate tactical gaps.

A few more notes about this scoped list:

- a cursory definition and URL to each item as they were added

- they were mapped to five identified “services/products” indicative of the major project work within the company

- another column was mapped four distinct outcomes (internal R&D, marketing/thought leadership, service offering, and/or product offering)

- another linked column - called Methods, Tools, Deliverables, and Resources - knit another knowledge repository to this

- more columns included links to other lists (associated roles, company partners, and marketing assets

- Finally, another column cross-referenced and linked to an extracted list of one month of the company’s sales funnel (and later 3-month). Each of the items in the sales funnel were assessed for their connection to the scoped item, and relationally linked.

This resulting list - with no other initial analysis - quickly identified the positives and negatives of day-to-day activity against sales activity, against the ability of the company to adjust to business challenges outside of known work.

With later analysis, gaps in product/service knowledge, timeliness of sales funnel items, and lack of understanding of current/future technologies stood out prominently.

Ripples of Scoped Activity

However, important seeing this was, it needed to inform the next shapes of executive activity: creating a vision and strategy for responding to technology and market challenges. So, how did this go?

It did not. The accidental ripple of just putting this mapping together was an indication of a larger gap in vision and execution, caused by mistakes in operations and business development. For example, less than 15% of the items found in the sales funnel (investigated artifacts for eventual proposal/sales pursuit) were applicable to the technologies noted on the scoping list. And while the existing work could map to the scoping list, there was a larger gap between the products and (in this case) the FICAM model used to shape the known products. If you will, one part of executive management ran a product but it wasn’t clearly linked to sales and business development activity - a lack of cohesive knowledge.

What could have been done?

- prioritizing the scoped items based on market conditions and business capability

- leveraging the marketing/thought-leadership items for quick content activities spread out across multiple persons

- refining the product listing to clarify pure product, versus co-opted product, versus service, versus desired product/service

- refining the sales/business development funnel to conform first to the product focuses, then to the scoped items, and finally to the adjacent roles identified

We identified a few other items specific to executive coaching, operational improvements, and program management maturity. Because of this and other lists/maps, much was heard (and will leave that there).

Reclaiming Some Gains

But, it was not all a loss. There were parts of the main projects which benefited from linking of obscure product/service lines and louder topics heard beyond the project space. Experienced persons took the framing and tuned their tactics to acclimating the language of the future-scoped topics, and then pulled those into their tasked work relevant research, analysis, or tweaks to implantations. This also led to improved documentation for some mid/large scale operations, and identified other role-gaps with team construction.

As this list was generated and branched from a few other frameworks, it allowed for more direct professional development discussions - some of which were challenging due to a wider technical knowledge gap than noted in an initial organizational analysis.

An accidental ripple unveiled major improvement needed for data coming from the sales/business development team. The data shared was an extract of another data product, and therefore missed notable features such as summaries of the content of the RFPs/RFIs, association to partners and competitors, and timeliness of the content (from addition into the data set to when it was last reviewed). If you will, this list exposed the siloed shape of business development, and answering quickly about specific and desired outcomes.

Avanceé Lessons

And for Avanceé, what did we learn? One of the most challenging aspects of strategy is shifting up to scoping, while also shifting down to tactics. Not being responsible for scope or tactics puts leadership in a challenging place when there is little understanding of the environment. Strategy - while valuable and what many might want - comes after clarity, not before.

What can Avanceé offer to companies who might be in a similar situation of needing/wanting a clearer strategy or tactics which better align with market scope company talent? That’s worth a conversation… but, it won’t be too dissimilar from the image noted on this post, or a similar map. After that, it will be up to your leadership team to execute based on re-engineering that vision.